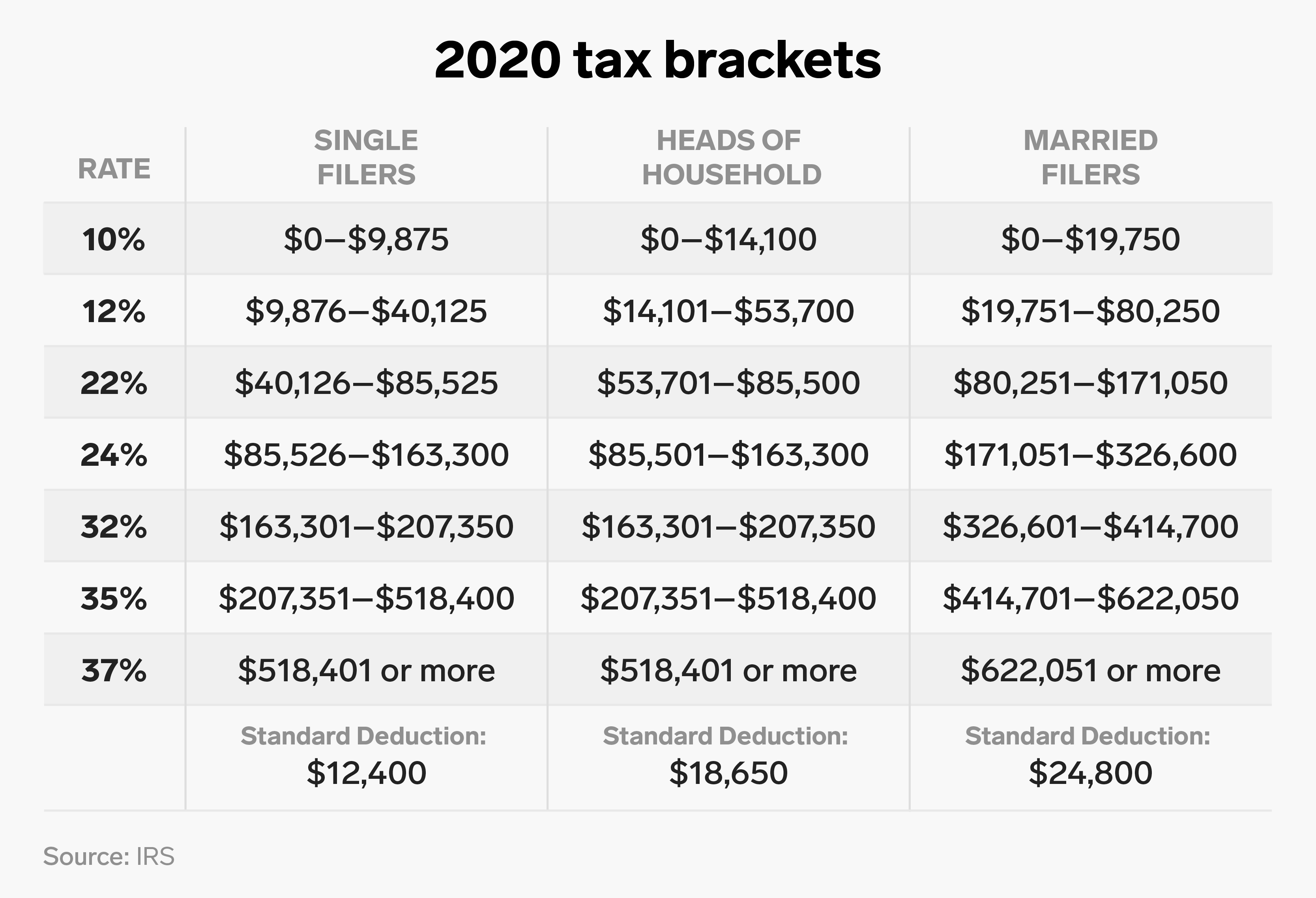

Tax Brackets 2020 Long Term Capital Gains . for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). There are three tax rates—0%, 15%. capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020.

from aptrilo.weebly.com

for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. There are three tax rates—0%, 15%. capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020.

Capital gains tax brackets aptrilo

Tax Brackets 2020 Long Term Capital Gains [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). There are three tax rates—0%, 15%.

From www.advisorsmanagement.com

What You Need to Know About 2020 Taxes Advisors Management Group Tax Brackets 2020 Long Term Capital Gains capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. There are three tax rates—0%, 15%. for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. based on the capital gains tax brackets listed earlier,. Tax Brackets 2020 Long Term Capital Gains.

From www.financestrategists.com

LongTerm Capital Gains Tax Rate 20232024 Tax Brackets 2020 Long Term Capital Gains capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). based on the capital gains tax brackets listed earlier, you'll pay a. Tax Brackets 2020 Long Term Capital Gains.

From aptrilo.weebly.com

Capital gains tax brackets aptrilo Tax Brackets 2020 Long Term Capital Gains based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. There are three tax rates—0%, 15%. for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. [2] in 2020,. Tax Brackets 2020 Long Term Capital Gains.

From www.taxpolicycenter.org

Who Benefits From The Zero Percent Tax Bracket For Capital Gains And Tax Brackets 2020 Long Term Capital Gains [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). There are three tax rates—0%, 15%. based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. . Tax Brackets 2020 Long Term Capital Gains.

From www.xyplanningnetwork.com

Capital Gains vs. Ordinary The Differences + 3 Tax Planning Tax Brackets 2020 Long Term Capital Gains [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. based on the capital gains tax brackets listed earlier, you'll pay a. Tax Brackets 2020 Long Term Capital Gains.

From camelliawjoby.pages.dev

Capital Gains Tax 2024 Nada Tallie Tax Brackets 2020 Long Term Capital Gains There are three tax rates—0%, 15%. for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. [2] in 2020,. Tax Brackets 2020 Long Term Capital Gains.

From www.freshbooks.com

Capital Gains Tax Definition & Calculation Tax Brackets 2020 Long Term Capital Gains based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. capital gains rates for individual increase to 15% for. Tax Brackets 2020 Long Term Capital Gains.

From www.financialsamurai.com

ShortTerm And LongTerm Capital Gains Tax Rates By Tax Brackets 2020 Long Term Capital Gains for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). There are three tax rates—0%, 15%. based on the capital. Tax Brackets 2020 Long Term Capital Gains.

From www.taxpolicycenter.org

How are capital gains taxed? Tax Policy Center Tax Brackets 2020 Long Term Capital Gains based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). capital gains rates for individual increase. Tax Brackets 2020 Long Term Capital Gains.

From www.lifelivedforward.com

TaxEfficient Investing Why Tax Planning and Investments Should Work Tax Brackets 2020 Long Term Capital Gains based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. There are three tax rates—0%, 15%. capital gains rates. Tax Brackets 2020 Long Term Capital Gains.

From kindnessfp.com

Capital Gains vs. Ordinary The Differences + 3 Tax Planning Tax Brackets 2020 Long Term Capital Gains for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. There are three tax rates—0%, 15%. based on the capital gains tax brackets listed earlier,. Tax Brackets 2020 Long Term Capital Gains.

From www.forbesindia.com

Long Term Capital Gains (LTCG) Tax Rates, Calculation, And More Tax Brackets 2020 Long Term Capital Gains [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. There are three tax rates—0%, 15%. based on the capital gains tax. Tax Brackets 2020 Long Term Capital Gains.

From printableslashasylumt7.z22.web.core.windows.net

Guide To Capital Gains Tax 2022 Tax Brackets 2020 Long Term Capital Gains based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. [2] in 2020, the income limits for all tax. Tax Brackets 2020 Long Term Capital Gains.

From www.businessinsider.in

Capital gains tax rates How to calculate them and tips on how to Tax Brackets 2020 Long Term Capital Gains [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. based on the capital gains tax brackets listed earlier, you'll pay a. Tax Brackets 2020 Long Term Capital Gains.

From fionapullman.pages.dev

Long Term Capital Gains Tax Rate 2025 Table 2025 Fiona Pullman Tax Brackets 2020 Long Term Capital Gains [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. for taxable years beginning in 2023,. Tax Brackets 2020 Long Term Capital Gains.

From www.taxpolicycenter.org

How are capital gains taxed? Tax Policy Center Tax Brackets 2020 Long Term Capital Gains capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. There are three tax rates—0%, 15%. based on the capital gains tax brackets listed earlier, you'll pay a 15% rate, so the gain will add $300 to your tax bill for 2020. [2] in 2020, the income. Tax Brackets 2020 Long Term Capital Gains.

From thecollegeinvestor.com

Capital Gains Tax Brackets And Tax Rates Tax Brackets 2020 Long Term Capital Gains There are three tax rates—0%, 15%. capital gains rates for individual increase to 15% for those individuals with income of $40,001 and more ($80,001 for married. for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. [2] in 2020, the income limits for all tax. Tax Brackets 2020 Long Term Capital Gains.

From elchoroukhost.net

Fed Tax Tables 2019 Elcho Table Tax Brackets 2020 Long Term Capital Gains [2] in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). for taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals. capital gains rates for individual increase to 15% for those. Tax Brackets 2020 Long Term Capital Gains.